how to determine unemployment tax refund

Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before. Fastest tax refund with e-file and direct deposit.

Average Income Tax Preparation Fees Increased In 2015

Domestic trust and your 2020 tax return was or would have been had you been required to file for a full 12 months.

. The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their withholding consider additional tax payments or submit a new Form W-4 to their employer. To determine the amount or legality of a tax fine penalty or addition to tax that was contested before and adjudicated by a court or administrative tribunal of competent jurisdiction before the date of the bankruptcy petition filing. The total tax shown on your 2021 return minus the amount of tax you paid through withholding is less than 1000.

In some cases the EIC can be greater than the total income taxes owed for the year. Any resulting overpayment of tax will be either refunded or applied to other taxes owed. Fastest Refund Possible.

To protect the public and employees and in compliance with orders of local health authorities around the country certain IRS services such as live assistance on telephones. To decide the right of a tax refund for the bankruptcy estate before the earlier of. Ongoing tax return processing delays and additional reviews mean many tax filers are getting multiple letters from the IRS including ones stating that their tax return and refund payment will be further delayed for up to an additional 60 days.

All inquiries and requests for the DOES UI Tax Division should be emailed to email protected. Each employers tax rate may vary from year to year depending on previous experience with unemployment and the rate schedule in effect. This process of determining may take a few days and claimants will be notified via mail.

Two common ways of reducing your taxes owing andor improving your tax refund are credits and deductions. STATUS UNIT The Status Units primary function is to determine employer liability for UI Tax purposes ensure. The tax brackets you fall into can also help you make decisions about when and how to claim certain deductions and credits.

For taxpayers who already have filed and figured their 2020 tax based on the full amount of unemployment compensation the IRS will determine the correct taxable amount of unemployment compensation. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Key Takeaways If you expect to owe more than 1000 in federal taxes for the tax year you may need to make estimated quarterly tax payments using Form 1040-ES or else face a penalty for underpayment.

The IRS issues more than 9 out of 10 refunds in less than 21 days. Fastest federal tax refund with e-file and direct deposit. Tax credits are amounts that reduce the tax you pay on your taxable income.

Please see below for a detailed listing of inquiry andor request types and associated ATTNs for submissions to the email protected mailbox. Find in-depth news and hands-on reviews of the latest video games video consoles and accessories. Qualified sick leave wages are wages for social security and Medicare tax purposes determined without regard to the exclusions from the definition of employment under section 3121b1-22 that an employer pays with respect to leave taken after March 31 2020 and before April 1 2021 under the Emergency Paid Sick Leave Act EPSLA as.

Tax refund time frames will vary. Meanwhile Social Security and Medicare payments constitute FICA taxes. The IRS will automatically refund money to people who already filed their tax return reporting unemployment compensation or in some circumstances the IRS will apply the refund money to tax debts or other debts owed by the person entitled to the.

March 12 2021. The IRS is reviewing implementation plans for the newly enacted American Rescue Plan Act of 2021. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up.

The wage base limit is the maximum wage subject. As with a paper return you may not get all of your refund if you owe certain past-due amounts such as federal tax state income tax state unemployment compensation debts child support spousal support or certain other federal nontax debts such as student loans. Customer service and product support hours and options vary by.

Ways to get into a lower tax bracket. In total these taxes amount to 153 of an employees gross income divided between employee and employer. If your federal income tax withholding plus any timely estimated taxes you paid amounts to at least 90 percent of the total tax that you will owe for this tax.

Tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days. The most common uses of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received that year.

Get your tax refund up to 5 days early. RealPlayer 2020 is the fastest easiest and fun new way to download and experience video Les Chaines Tv TNT Francaises en Direct de France There are also a few smaller channels and user broadcasts that change randomly 5 hours of jam-packed stories Cartoon HD works on all devices. Federal income tax is determined by the tax brackets passed by Congress and approved by the IRS.

This calculator will determine if you qualify for. Once an employer becomes eligible for experience rating they will receive one of 18 unemployment insurance UI tax rates ranging from 25 percent to 540 percent of taxable wages. The Internal Revenue Service reminds taxpayers and tax professionals to use electronic options to support social distancing and speed the processing of tax returns refunds and payments.

Additional information about a new round of Economic Impact Payments the expanded Child Tax Credit including advance payments of the Child Tax Credit and other tax provisions will be made available as soon as possible on IRSgov. This provides an income tax refund to families that may have little or no income tax withheld from their paychecks. They may get the We need an additional 60 days notice from the IRS several times each one extending the delay in getting.

Unemployment Compensation Subject to Income Tax and Withholding. Email protected ATTN. For more information about estimated tax payments or additional tax payments visit payment.

Withhold federal income tax from each wage payment or supplemental unemployment compensation plan benefit payment according to the employees Form W-4 and the correct withholding table in Pub. If you have already filed your 2020 Form 1040 or 1040-SR you should not file an amended return. French Tv Series Download.

To determine whether the total tax is less than 1000 complete Part I lines 1 through 7. In addition any state tax refund you may be due will be applied to the. You can still claim the special exclusion for unemployment compensation received in tax year 2020 if you havent filed your 2020 tax return and your AGI is less than 150000.

When you file for a new benefit year it will be reviewed as a new state unemployment claim and KDOL will determine your eligibility for either state or federal benefits. Tax year 2020 returns can be filed electronically only by paid or volunteer tax return preparers. Especially if they owed taxes or received a large refund when filing their 2021 tax return.

The agency will do these recalculations in two phases. Refer to this article for the current federal income tax brackets.

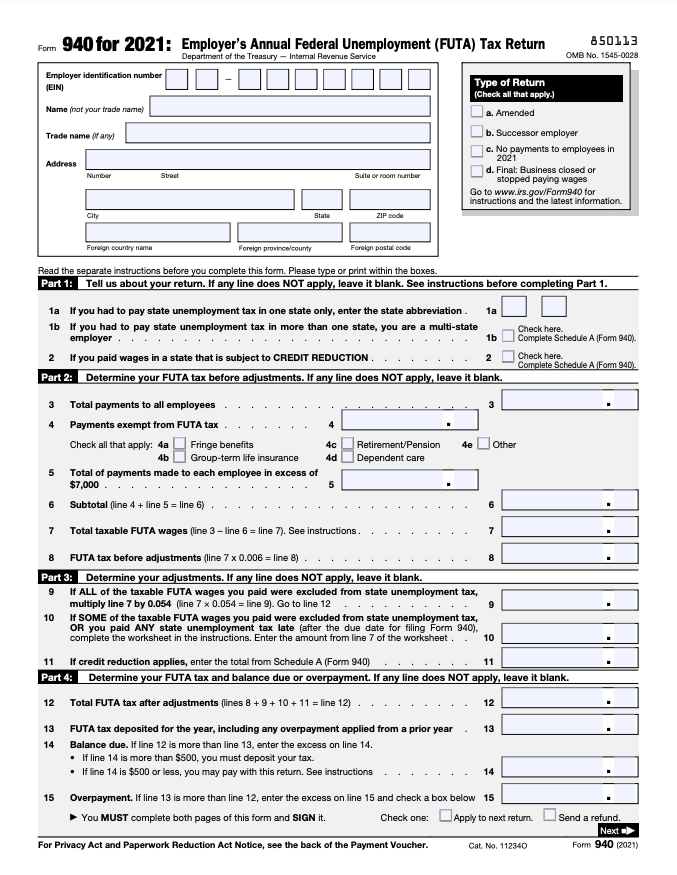

Form 940 When And How To File Your Futa Tax Return Bench Accounting

Unemployment Taxes Will You Owe The Irs Credit Com

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Bookkeeping Business Business Tax Small Business Bookkeeping

Tax Preparation Checklist Tax Prep Tax Preparation Income Tax Preparation

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Self Employed Taxes How To Get Organized Sweet Paper Trail

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Bookkeeping Business Business Tax Small Business Bookkeeping

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Correct Tax Refund 3d Human Stock Images Free

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeping Business

Stimulus And Taxes How To Shield Up To 10 200 In Unemployment Benefits From Income Taxes Syracuse Com

.png)

Where Do I Find My State Unemployment Tax Form To Print For Filing I Only See 1 Form In Archived Filings And That Is For The 2nd Qtr 2020

The Economic Effects Of Automation Aren T What You Think They Are Single Lunch Ai Automation Jobs Economic Trends Thinking Of You Job Automation

Comments

Post a Comment